WindowMaster releases half-year report 2022: Historically high order intake and revenue, and strong rebound in profitability in Q2

torsdag den 18. august 2022 | Selskabsmeddelelser

Company Announcement No. 028-2022 – Inside information

Vedbaek, 18th August 2022

Financial Highlights H1 2022 - Historically high order intake and revenue, and strong rebound in profitability in Q2

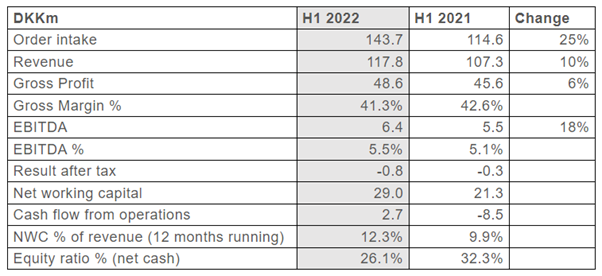

- Order intake increased 25% to DKK 143.7m in H1 2022 (H1 2021: DKK 114.6m)

- Revenue increased 10% to DKK 117.8m in H1 2022 (H1 2021: DKK 107.3m)

- EBITDA increased 18% to DKK 6.4 (H1 2021: DKK 5.5m) corresponding to an EBITDA margin of 5.5% (H1 2021: 5.1%)

- The outlook for 2022 is maintained. Revenue is still expected to be in the range of DKK 220-235m and EBITDA between DKK 13-18m. However, based on the developments in Q2, both revenue and EBITDA are now expected to be in the upper end of the guided ranges.

FINANCIAL KEY FIGURES H1 2022

Erik Boyter, CEO comments on the developments in the first half: “We are pleased to report that the challenges we experienced in terms of cost inflation in Q1 have been mitigated through price actions in Q2, which means that the half-year results are in line with budget, allowing us to maintain our guidance for the full year with a bias towards the high end of the range. Market activity is high, and our opportunity pipeline is growing, which bodes well for our future growth prospects.”

MARKET ACTIVITY

In general, market activity is high and investments in intelligent natural ventilation solutions are on the rise – both for new buildings and integrated offerings for full indoor climate solutions, and for refurbishment of existing buildings.

Demand is driven by investments in energy efficient solutions and environmental regulation in both EU and US. In the EU, the demand is fueled by the EU’s Green Deal and the REPowerEU-plan. Building renovation is one of the most important and efficient solutions to address both climate change and reliance on fossil fuels.

In the US, the market for green technology is very attractive, and activity is high. Demand is likely to be further supported by President Biden’s Climate agenda proposing plans to build a more resilient and sustainable economy. WindowMaster is the only manufacturer of window automation in the intelligent natural ventilation niche with local presence in the US. In 2016, a subsidiary was established in the Bay Area in California, and in 2019, the national distributor Clearline in Pennsylvania was acquired. An office is currently being established in Los Angeles, California. Order intake from the US increased 96% in H1 2022 vs. H1 2021.

In general, global supply chain constraints have led to more ordering in advance to secure deliveries on time, which is enhancing visibility and allowing for more efficient planning of resources.

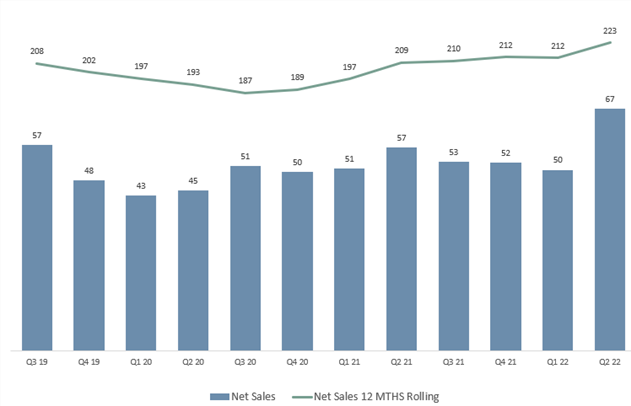

Order intake at the end of June 2022 was historically high. Order intake year-to-date amounted to DKK 143.7m (2021: DKK 114.6m) and 12-months-trailing order intake amounted to DKK 252m (FY 2021: DKK 224m), representing growth rates of 25% and 12.5%, respectively.

Quarterly developments in order intake

BUSINESS MODEL

WindowMaster’s business is split in three types of offerings.

The first area is Projects. This relates to integrated offerings of full indoor climate solutions, which typically include sale of products such as sensors, motors and controllers, sales of hours (project management, installation, and commissioning), programming, and various documentation. This offering is especially targeting building owners, contractors, façade builders and fenestration manufacturers. Increased scope and sale of integrated offerings are driving top line growth but have a slightly diluting impact on the gross margin. WindowMaster possesses comprehensive knowledge of integrating and controlling different building automation solutions (Solar Shading, Hybrid ventilation, Natural ventilation, Smoke and Heat ventilation, etc.) with the companies’ control systems.

Based on the 32-year history of WindowMaster, many of the previously installed solutions are now ready to be refurbished and technological updated, and the target is to leverage the installed base for refurbishment jobs and service work. Refurbishments are driving both top-line growth and margin expansion.

The second area is Products. This includes recurring revenue from product sales to OEMs, distribution- and installation partners. The product portfolio within natural indoor climate solutions consists of a variety of specialty products such as controllers, motors, sensors, detectors, actuators, and accessories. The legacy Heat & Smoke business is increasingly converging with and becoming an integrated part of the natural ventilation solutions.

WindowMaster has built a scalable efficient production platform in Herford (Germany), which has proved to be an effective way of servicing global customers.

The third area is Service. Service contracts provide a stable and recurring revenue as well as increased customer satisfaction. Service contracts will typically include annual inspection as well as service and maintenance of moveable components and repair of minor errors and damages. Service contracts are driving both top-line growth and margin expansion.

With effect from 1 January 2021, WindowMaster acquired the Danish company, Climatic A/S with a view to growing the service business. Climatic is active within two business areas: Safety and Fall protection systems, and Comfort and Fire ventilation systems based on energy-friendly natural air exchange. Originally, it was the intention to spin-off the Safety and Fall protection business. However, it has been decided to keep and develop the business to leverage synergies on the customer side. The Safety and Fall protection business currently delivers a slightly lower gross margin than the average of WindowsMaster’s business.

FINANCIAL DEVELOPMENTS H1 2022

Revenue

Revenue in H1 amounted to DKK 117.8m (H1 2021: 107.3m) equivalent to an increase of 10%. primarily explained by growth in product sales and partly from more project sales.

Quarterly developments in Revenue

Gross profit

Gross profit amounted to DKK 48.6m in H1 (H1 2021: DKK 45.6m) equivalent to a gross margin of 41.3% (H1 2021: 42.6 %). The decrease in the gross margin is related to higher cost prices in Q1 that were not fully offset by higher prices. This has been rectified in Q2.

EBITDA

Operating profit (EBITDA) amounted to DKK 6.4m in H1 (H1 2021: DKK 5.5m) equivalent to an EBITDA margin of 5.5% (H1 2021: 5.1%). The increase in the EBITDA margin is explained by higher turnover and effect from higher prices in Q2.

The first quarter of the year was marked by high uncertainty and significant cost increases related to constraints in the global supply chain. However, the implementation of permanent price increases at the beginning of the year as well as temporary price supplements in the second quarter have mitigated the negative effects of cost increases incurred at the beginning of the year.

Cash flow and working capital

Cash flow from operating activities in H1 amounted to DKK -0.9m (H1 2021: -8.5m). The improvement on last year is primarily attributable to increased profitability, however partly off-set by a slight increase in net working capital. Cash flow from investment activities in H1 amounted to DKK -3.9m (H1 2021: -14.3) and were related to ERP, as well as investments in product development and tests. Investments in H1 2021 included the acquisition of Climatic A/S.

At the end of H1, net working capital amounted to DKK 32m (End of 2021: 29m). Net working capital as a percentage of revenue (12-month running) worsened to 14.4% (End of 2021: 13.6%)

Net working capital increased towards the end of 2021 and further in H1 due to a deliberate management decision to increase inventories and purchasing of strategically important electronic component on the spot market to be able to meet anticipated demand with competitive delivery times. No further increases in net working capital are anticipated in H2, and thus operating income is expected to flow through to free cash flow in H2.

Cash and financial position

Net interest-bearing debt at the end of H1 amounted to DKK 40.0m (End of 2021: 35.2m). The change is primarily related to the increase in net working capital as explained above. Access to capital and good banking relationships have proved to be a source of competitive advantage.

Financial gearing calculated as NIBD/EBITDA amounted to 3.8 at the end of H1. (End of 2021: 3.6). The target is to be below 2.0.

At the end of H1, Equity amounted to DKK 33.3m (End of 2021: 35.4), equivalent to an equity ratio of 26%. The target is to be above 30%.

Risks

WindowMaster is exposed to market risks including currency risks, interest risks and commodity price risks as part of its ongoing operations and investment activities. As a supplier to the global construction industry, the company is also exposed to cyclical market developments and a potential economic slowdown.

The key commercial risks relate to the company’s ability to effectively manage the anticipated growth. This involves attracting sufficient and skilled employees and safeguarding the level of competencies and market knowledge within the company. Additionally, the company is dependent on consistent and timely delivery of materials from suppliers to the assembly facility in Herford, Germany.

Outlook for 2022

The outlook for 2022 is maintained. Revenue is still expected to be in the range of DKK 220-235 mill. and EBITDA is still expected to be between DKK 13-18 mill. However, based on the developments in Q2, both revenue and EBITDA are now expected in the upper end of the guided ranges. Unforeseen events such as Covid-19, geo-political uncertainty and supply disruptions may impact developments in the remainder of the year.

CONFERENCE CALL

WindowMaster invites investors to participate in a live video event on 19 August 2022 at 13:00 CET. The company’s CEO, Erik Boyter, and CFO, Steen Overgaard Sørensen will present the company’s half year report in Danish. (Register at: https://hcandersencapital643.clickmeeting.com/windowmaster-praesentation-af-h1-2022/register.)

FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements. Words such as ‘believe’, ‘expect’, ‘may’, ‘will’, ‘plan’, ‘strategy’, ‘prospect’, ‘foresee’, ‘estimate’, ‘project’, ‘anticipate’, ‘can’, ‘intend’, ‘outlook’, ‘guidance’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance identify forward-looking statements. Statements regarding the future are subject to risks and uncertainties that may result in considerable deviations from the outlook set forth. Furthermore, some of these expectations are based on assumptions regarding future events which may prove incorrect.

For further information:

CEO, Erik Boyter

M: +45 4035 0267

Mail: ekb.dk@windowmaster.com

WindowMaster International A/S

Skelstedet 13

2950 Vedbæk

Denmark

Certified Advisor

Grant Thornton

Jesper Skaarup Vestergaard

Direct(+45) 35 27 50 11, Mobile (+45) 31 79 90 00

Grant Thornton

Stockholmsgade 45

2100 Copenhagen Ø

Denmark